After conducting some diagnostic work on my forecasting models for U.S. GDP growth and getting a clearer picture of the strengths and weaknesses of my models, its time to update my predictions for the remainder of the year, as well as take a quick look at how my previous predictions regarding the last several months have faired. To take a look at the specific diagnostic work that I conducted to test the accuracy of my predictive models and see what I found, see my previous post.

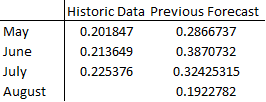

What I predicted several months ago was a spike in growth to above 0.3% in June and July, and then a drop off to around 0.2% for the rest of the summer, and then slightly lower growth still in the fall. What we have seen for the summer so far is a steady level of economic growth around 0.21%.

The major discrepancy between my forecast and how economical growth has actually played out so far is that my model predicted a large spike in net exports for June and July which never actually materialized. This is why the forecasted numbers are over inflated by comparison.

Going forward, my revised estimates for the rest of the year are somewhat more optimistic than the previous ones. Again my models predict that growth will start out high and then level out to closer to the historical average of about 0.2% per month towards the end of the year.

The shaded area in the graph represents the 95% confidence interval range for predicted growth, or the range of values that my model predicts growth to fall with about 95% certainty. Though there is no specific component of GDP that my model predicts to be unusually high on its own, as net exports was from my last predictions, I still believe that predictions of growth in August and September may be over inflated and end up closer to the lower end of the prediction range between 0.2% and 0.3%. This caution is based partly on the fact that my last estimates were slightly over inflated, and partly because of the news stories that I have been reading about stagnation in capital markets, which may in turn influence consumer confidence.

The shaded area in the graph represents the 95% confidence interval range for predicted growth, or the range of values that my model predicts growth to fall with about 95% certainty. Though there is no specific component of GDP that my model predicts to be unusually high on its own, as net exports was from my last predictions, I still believe that predictions of growth in August and September may be over inflated and end up closer to the lower end of the prediction range between 0.2% and 0.3%. This caution is based partly on the fact that my last estimates were slightly over inflated, and partly because of the news stories that I have been reading about stagnation in capital markets, which may in turn influence consumer confidence.

I have included the dashed line in the graph that represents the point prediction as well as the interval forecast, however I do not expect the actual growth figures to follow that line exactly as they unfold; if I were using this prediction for any sort of practical applications I would definitely keep the shaded area in mind for planning purposes. We can do our best to make predictions about what the future will bring, but it is ultimately uncertain and the interval captures that uncertainty much better than the point forecast does and lets us plan ahead with a little bit more flexibility, and when we are depending on forecasts for important decision making, that flexibility can make all the difference.